AI Redaction Can Make or Break a Deal

13 June 2023Five banking scenarios where protecting personally identifiable information (PII) is non-negotiable.

Bankers and capital markets professionals face multiple challenges. While ensuring transparency of operations, they must adhere to data privacy laws, protect sensitive information and be mindful of the ever-changing regulatory landscape — all while running transactions, satisfying deal stakeholder requirements and working on behalf of clients.

It’s a challenging balancing act. Thankfully, technologies such as virtual data rooms (VDRs) exist to help bankers and dealmakers efficiently and safely execute transactions. The best web-based VDRs include value-added features to make shrinking due diligence timelines go even faster and deal collaboration seamless.

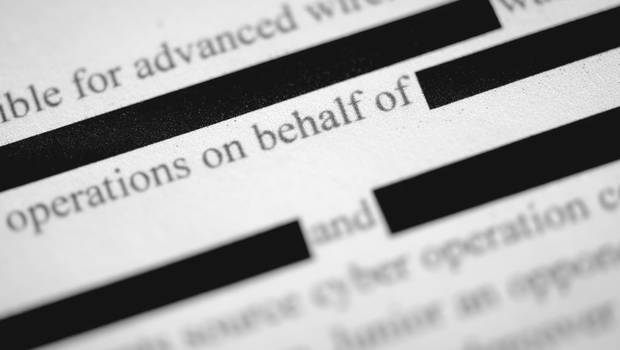

One of the most critical functions bankers need in their VDRs is artificial intelligence (AI) assisted redaction. AI redaction can quickly comb through thousands of pages, intelligently pinpointing and selecting content to redact from view while allowing access to the rest of the document. In a fast-moving market, AI redaction can shave off hours of manual effort, significantly preventing risk and freeing up team members to focus on higher-level tasks.

To help the Intralinks community gain more insight to the benefits of AI redaction, I put together a list of five important scenarios in which bankers and dealmakers will greatly benefit from VDRs with built-in AI-assisted redaction.

1. Loan portfolio sales

Oftentimes banks or other lenders will need to sell and offload portfolios of loans (non-performing or otherwise). It’s important to redact information within loan sale agreements and transfer deeds because of commercial sensitivities and privacy rights of third parties. Underlying transaction information, personally identifiable information (PII) like names, social security or national ID numbers, account details, etc. associated with underlying loans MUST be blocked from view; otherwise, there is the risk of this information being compromised or used for malicious purposes.

However, extensive redactions can be subject to legal scrutiny, and buyers and sellers may argue about retaining and/or undoing redactions. Generally, redacted information must be both irrelevant and confidential, but even this criteria is debatable. This means that sellers of loan portfolios must take a careful approach to reviewing and redacting — better yet, they must have the ability to quickly review, redact and un-redact if needed to avoid litigation or other legal obstacles.

2. Debt collections

Throughout the lifetime of a loan, massive amounts of sensitive information about the borrower can be unnecessarily exposed to entities peripheral to the lender or organization managing the loan. Therefore, redaction is essential.

Multiple regulations require redaction of customer information in loan defaults and bankruptcies. For example, the Fair Debt Collection Practices Act specifies blocking debit and credit card numbers, expiration dates, CVV codes, PIN numbers, account numbers, routing numbers, last four digits of social security numbers, numeric portions of mailing addresses, zip codes, dates of birth, balances due, payment amounts, settlement offers and phone numbers.

Similarly, the Federal Rule of Bankruptcy Procedure 9037 requires banks to secure customer information or “personal data identifiers,” such as account numbers, tax identification numbers and social security numbers so that when individuals file for bankruptcy, the documents in all formats — PDF, Word, spreadsheets, etc. — are ready for legal proceedings.

3. Structured finance and securitizations

When multiple assets and loans are pooled and repackaged as interest-bearing investment vehicles, the amount of sensitive, PII contained therein grows exponentially. In structured finance, there is again the need to balance transparency and protecting PII. Section 942 of the Dodd-Frank Act (which was adopted to address abuses in the asset-backed securities market resulting from the financial crisis) explains that when information is made public on the SEC EDGAR database, it’s recommended to redact information that would uniquely identify individual debtors (e.g. social security numbers, names, and street addresses) and replace exact data values with broad ranges.

Outside of the U.S., the Basel Committee on Banking Supervision (BCBS) Framework advises that while investors should have access to all information on the terms of the liquidity facilities and credit support, redaction of sensitive information in underlying transactions is necessary before the due diligence and credit risk evaluation process.

4. IPOs

The process can be even trickier for bankers and corporate dealmakers embarking on an initial public offering (IPO). Redaction is necessary to protect proprietary product or service information from getting into the hands of competitors, but potential investors will demand full transparency to be able to assess the valuation and share price. What’s a pre-IPO firm to do?

This is when the ability to quickly redact and un-redact is crucial. The issuer may opt to follow SEC guidance on redactable information (i.e. pricing terms, trade secrets, purchase requirements) to protect against competitive harm and then decide to undo redactions if key investors threaten to withdraw from the deal. While the issuer weighs the pros/cons of over- versus under-redaction, this functionality gives them the flexibility and speed to address their evolving needs and priorities.

5. Other strategic financing (M&A and more)

Redaction is a necessary exercise across many investment banking functions — advisory, restructuring, mergers, acquisitions and more —nearly all of which require contract review. Investment bankers and deal teams must also bear in mind the necessary filing of documents to the SEC in the U.S., ESMA in Europe and other related authorities. Banks often dedicate back office and/or offshore teams for these purposes. This can be a costly investment, not just in terms of physical capital and human resources, but also the financial and reputational consequences resulting from errors or delays in the process. Even when a hybrid digital-manual redaction process is in place, it can get unruly, disorganized and involve repeat work, especially when there is a need to review, proofread and possibly un-redact content later on.

Conclusion

The process of redaction is critical to the success of deals and transactions. Done manually, it is tedious, repetitive and time- and resource-consuming. Add to that the potential for severe consequences — financial or reputational — that can result from a missed or an overuse of redaction. Fortunately, bankers and capital markets professionals can immediately benefit from technology solutions that automate and incorporate artificial intelligence in the redaction process, particularly if these are integrated into secure virtual data rooms for transaction due diligence.

Patricia Gatmaitan

Patricia is director of product marketing for banking and securities at Intralinks, responsible for content and go-to-market strategy for the debt capital markets business. Prior to joining Intralinks in 2019, Patricia held senior product marketing and communications roles at global financial services firms including Envestnet, IHS Markit, and Morgan Stanley.