Avondale Partners accelerated M&A deal velocity by 25% with Intralinks

28 October 2014

Avondale Partners is a Nashville, Tennessee-based, employee-owned investment banking and asset management firm, nationally known for its healthcare expertise.

The Situation

Avondale Partners’ investment banking division facilitates numerous M&A and private capital transactions every year. For these projects, its analysts used virtual data room (VDR) solutions from multiple vendors. At the beginning of each new project, Avondale’s analysts would undergo a time-consuming process, asking VDR vendors for pricing proposals, and then presenting the different options to their clients.

With some vendors, launching and configuring a VDR could be laborious, requiring manual assistance from the customer support teams. “Some VDRs don’t preserve the structure of the folders you want to use during the project,” says Avondale analyst Tom Divinnie. “When that happens, you have to spend all sorts of time recreating folder structures. Obviously, this is not a great use of our time.”

The Solution

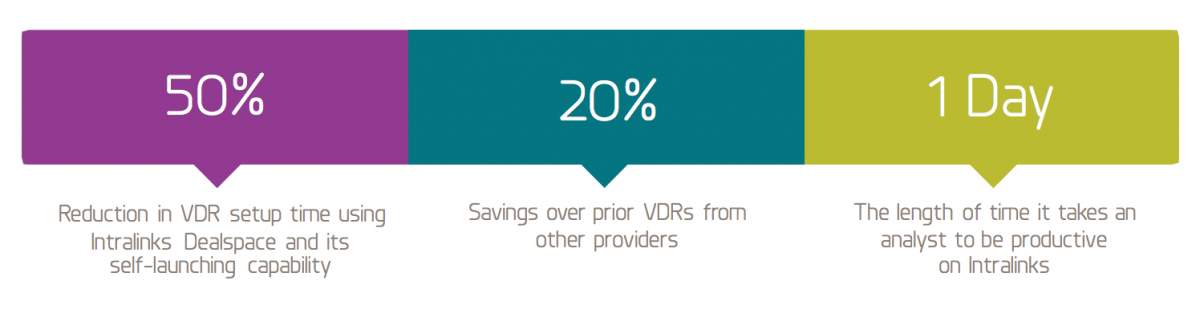

After evaluating multiple VDR solutions, Avondale standardized on Intralinks for all sell-side M&A activities. By committing to being an Intralinks preferred partner, Avondale was also able to realize a 20 percent cost reduction — as compared to what it had been spending with other vendors.

The Benefits

Divinnie says Intralinks saves him and his fellow analysts significant time and effort in launching VDRs for M&A projects. “As an Intralinks preferred partner, we now have self-launch capabilities with Intralinks, which means we can launch VDRs as we need them with no vendor assistance.”

“Intralinks is also very intuitive,” Divinnie says. “We found that a new analyst can be a productive … user in one day, while with other solutions it can take a week or more.” This is an acceleration of 85 percent.

“Finally,” he adds, “[Intralinks] preserves all folder structures, so we don’t have to spend time on tedious reconstruction activities. Overall, [Intralinks] has reduced set-up time by 50 percent over our previous VDR approach.”

Divinnie says that Intralinks’ granular permissions module helps tighten control of the deal marketing process. It also mitigates the risk of inappropriate content sharing. “When running a broad process, you need to be able to reduce the opportunity for human error. We can do that by viewing permissions for each party involved, which minimizes the chances of exposing the wrong information to the wrong organization.”

Intralinks’ reporting capabilities help Avondale successfully understand counterparty intent, and formulate effective strategy. “We can run detailed access reports so we know exactly who has looked at which documents,” Divinnie observes. “This gives us valuable intelligence on the motivations of potential buyers, and we use this intelligence to guide our strategy for narrowing the field of potential buyers and driving the deal to a successful close.”

Avondale anticipates leveraging Intralinks for deal marketing — using the platform to distribute non-disclosure agreements, teasers, and confidential information memorandums.